Content

The LIFO reserve is the difference between the FIFO and LIFO cost of inventory for accounting purposes. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

- This calculation is hypothetical and inexact, because it may not be possible to determine which items from which batch were sold in which order.

- The LIFO method is most commonly applied to an organization’s inventory valuation procedures.

- As a 501 nonprofit, we depend on the generosity of individuals like you.

- Ending inventory is a common financial metric measuring the final value of goods still available for sale at the end of an accounting period.

- The following table shows the various purchasing transactions for the company’s Elite Roasters product.

Under LIFO, the most recent items added to inventory are assumed to be the first items sold. The cost of goods sold is based on the costs of the most recent items purchased or manufactured. Suppose a business purchases three units of inventory throughout the https://kelleysbookkeeping.com/ year at three different prices ($30, $31, and $32). The LIFO method requires you to apply your most recent inventory costs to COGS first. When you do so, you’ll give yourself and your investors an accurate look at how you’re currently doing financially.

An Example of LIFO Calculation

By using this method, you’ll assume the most recently produced or purchased items were sold first, resulting in higher costs and lower profits, all while reducing your tax liability. LIFO is often used by gas and oil companies, retailers and car dealerships. The LIFO method is most commonly applied to an organization’s inventory valuation procedures. There are a lot of different valuation methodologies applied to inventory, and often management has to make a strategic decision to determine the most advantageous method to use. Under LIFO, the valuation is structured around the concept that the last unit of inventory received is the first unit of inventory used.

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. The remaining unsold 450 would remain on the balance sheet as inventory for $1,275. Brad would now like to run a report for his partners that shows the cost of goods sold. The LIFO method is used in the COGS calculation when the costs of producing a product or acquiring inventory has been increasing.

accounting principles

Nonperishable commodities are frequently subject to LIFO accounting when allowed. LIFO is an inventory valuation method in which the most recently acquired items are assumed to be the first ones sold. The acronym LIFO stands for “last in, first out.” LIFO is used by businesses to manage inventory levels and costs. It can also be used to manage other assets, such as raw materials and finished goods. When a business uses LIFO, it records the most recent items first and the earliest items last. This means that the business will sell the most recent items first and the earliest items last.

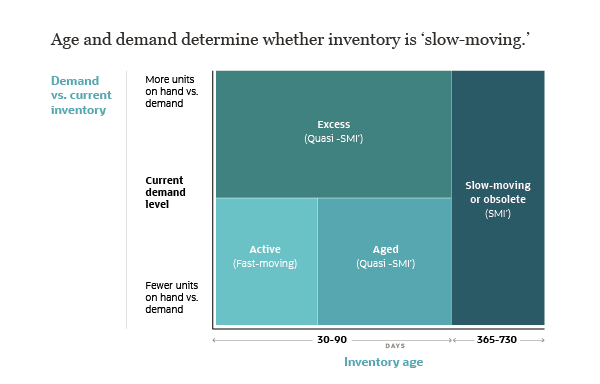

In other words, more expensive inventory is expensed before less expensive inventory effectively lowering profits and taxable income. This is why most companies choose to use LIFO vs FIFO for valuing their inventory. The trouble with the LIFO scenario is that it is rarely encountered in practice. If a company were to use the process flow embodied by LIFO, a significant part of its inventory would be very old, and likely obsolete. Nonetheless, a company does not actually have to experience the LIFO process flow in order to use the method to calculate its inventory valuation. The last in, first out method is used to place an accounting value on inventory.

What is LIFO?

LIFO (Last-in First Out) is an asset-management and inventory accounting method. Per this system, the assets received or manufactured last are the first to be sold. Older inventory is sold only after the newest inventory is sold. The purpose of this system is to simply account for the cost of this new inventory immediately. The inventory process at the end of a year determines cost of goods sold for a business, which will be included on your business tax return.

However, the main reason for discontinuing the use of LIFO under IFRS and ASPE is the use of outdated information on the balance sheet. Recall that with the LIFO method, there is a low quality of balance sheet valuation. Therefore, the balance sheet may Last In, First Out Lifo Definition contain outdated costs that are not relevant to users of financial statements. Under LIFO, the company reported a lower gross profit even though the sales price was the same. Now, it may seem counterintuitive for a company to underreport profits.